Navigating the complexities of legal representation often involves intricate financial transactions, and a crucial aspect of this process is the accurate and comprehensive legal service invoice.

Understanding the elements of a precise invoice for legal services is paramount for both clients and legal professionals to ensure transparency, clarity, and a smooth payment process.

This document acts as a legally binding record of the services rendered, detailing the agreed-upon fees, expenses, and any applicable surcharges.

A well-structured invoice for legal services provides a detailed breakdown of each billable task, ensuring both parties are aligned on the agreed-upon scope of work and the associated costs.

Accurate record-keeping is vital for both sides, enabling efficient financial management and resolving any potential disputes swiftly and effectively.

Knowing how to interpret an invoice for legal services allows clients to ascertain if the charges reflect the agreed-upon retainer or hourly rate.

This crucial document serves as a point of reference when queries about specific fees arise, and its proper format ensures financial accountability for all parties involved in the legal engagement.

From initial consultations to final settlements, a detailed invoice for legal services provides a transparent record of the rendered work and associated costs, which is fundamental to maintaining trust and fostering a positive professional relationship.

This article will delve into the nuances of correctly preparing and interpreting an invoice for legal services, providing a framework for both lawyers and clients to ensure a clear and mutually beneficial financial agreement.

Whether you are a seasoned legal professional or a client navigating a legal matter, a comprehensive understanding of the invoice for legal services is indispensable to ensure that everyone is on the same page financially.

Understanding the Structure of a Legal Service Invoice

A robust legal service invoice is a cornerstone of transparency and accountability within the legal profession.

This document provides a critical record of services rendered, meticulously detailing the scope of work, agreed-upon fees, and expenses incurred during the legal representation process.

Accurate invoicing practices are crucial for fostering trust and ensuring a smooth payment procedure between the legal professional and the client.

A well-structured invoice for legal services establishes a clear line of communication, avoiding misunderstandings and facilitating prompt payment.

The detailed breakdown of billable hours, specific tasks undertaken, and any associated costs presented in a legal service invoice is a fundamental aspect of managing legal expenditures.

A properly formatted invoice also ensures adherence to legal requirements and professional standards, safeguarding the interests of all parties involved.

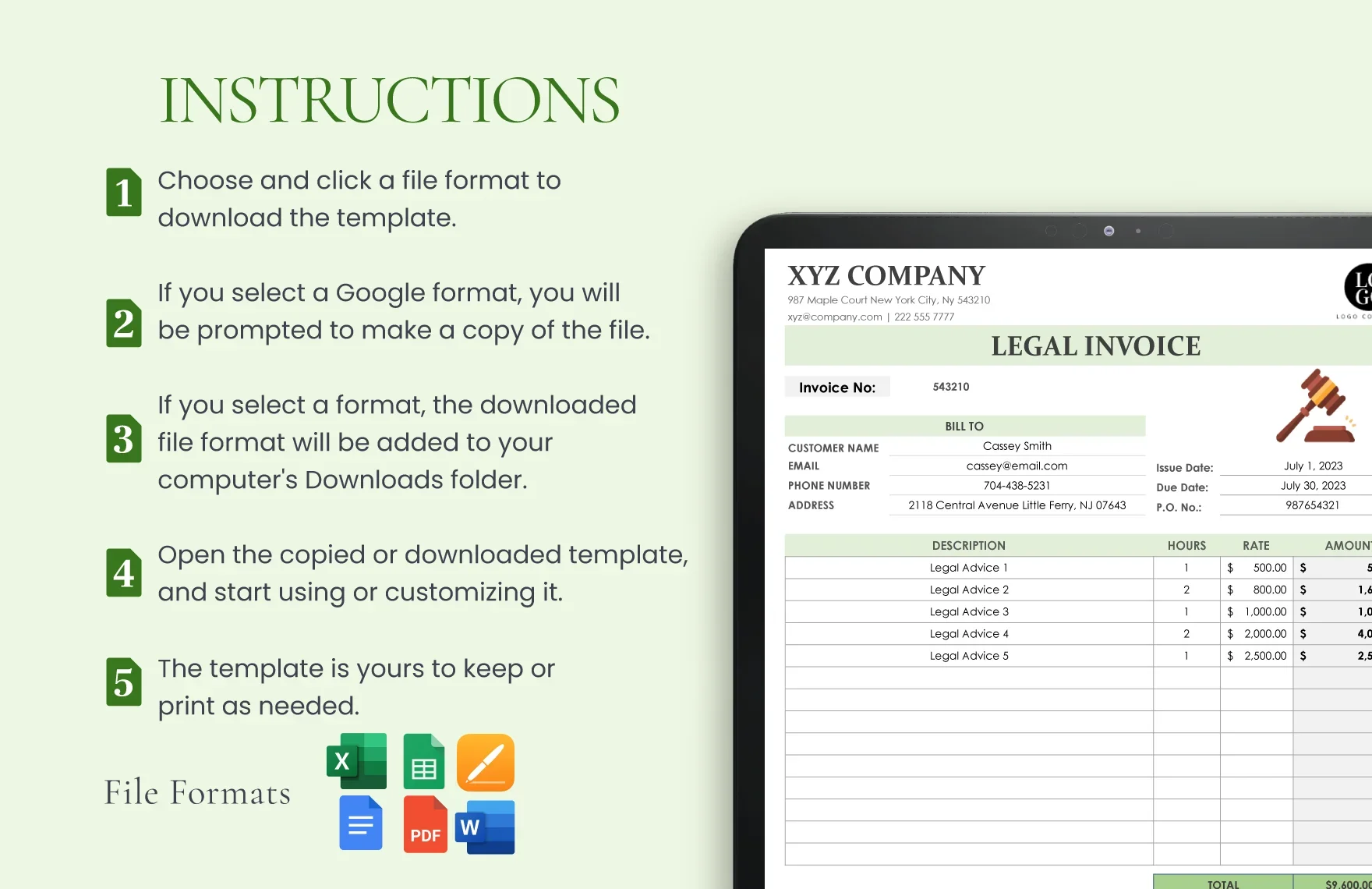

The structure of a legal service invoice typically includes essential elements such as the invoice number, date, and client information.

Furthermore, a comprehensive description of each service provided should be included, along with a breakdown of the associated fees.

This allows the client to ascertain the specific tasks covered by the payment and accurately assess the overall legal costs.

Itemizing expenses, such as court filing fees or expert witness fees, is vital for a comprehensive invoice for legal services. This ensures transparency regarding any additional out-of-pocket costs.

The invoice format often includes a detailed breakdown of billable hours, categorized by activity type, to clarify the time commitment for different aspects of the case.

Clear descriptions of the legal services performed, along with any applicable taxes and surcharges, are necessary elements within a detailed invoice for legal services.

This detailed approach not only simplifies the payment process but also provides a crucial record for potential future reference or dispute resolution.

In conclusion, the well-organized structure of a legal service invoice is fundamental for efficient financial management within the legal profession, promoting clarity and accuracy for all stakeholders.

This crucial document lays the groundwork for transparent financial dealings, enhancing trust between legal professionals and their clients.

Determining Applicable Legal Fees

Accurate calculation of legal fees is critical for a just and fair invoice for legal services.

Understanding the various components of legal costs is essential for both the client and the legal practitioner.

Different types of legal representation may lead to varying fee structures, necessitating meticulous attention to detail in the invoice for legal services.

Hourly rates, contingency fees, flat fees, and other methods of compensation should be clearly detailed on the invoice, reflecting the specifics of the agreed-upon arrangement.

A thorough understanding of the fee schedule and the associated legal services is vital for transparency in invoice preparation and to facilitate an efficient payment process.

Legal professionals should adhere to established legal and ethical guidelines for calculating fees. This ensures compliance and maintains trust in the professional services provided.

Time spent on research, document review, court appearances, and other activities directly related to the legal services rendered should be meticulously documented to create a verifiable record. A clear record of these activities is a vital component of the invoice for legal services.

The specifics of the legal case, the complexity of the issues, and the expertise required for the representation can all influence the calculation of fees. This variable nature of legal work demands an invoice for legal services that accurately reflects the value of the services provided.

Recognizing potential costs such as travel expenses, court filing fees, or expert witness fees, and explicitly including them in the invoice for legal services, ensures transparency for clients regarding total costs.

Detailed accounting for these associated expenses provides a complete picture of the total value of the legal representation, clearly outlined on the invoice for legal services.

Fees for court appearances or travel time should be itemized separately on the invoice for legal services to ensure complete understanding by the client.

Moreover, the invoice for legal services should clearly delineate how any contingency fee arrangements work, outlining percentages and potential outcomes.

This ensures that the client is fully informed of the potential costs and benefits associated with the legal representation, as detailed in the invoice for legal services.

A clear breakdown of the specific services rendered under various categories allows for a precise calculation of fees, creating a transparent and readily understandable invoice for legal services.

Such meticulous documentation, presented accurately on the invoice for legal services, mitigates any possible future disputes related to fees or expenses.

Understanding the legal framework and professional ethics surrounding fees is essential for creating an invoice for legal services that is both fair and legally compliant.

By adhering to these guidelines, legal professionals can produce accurate and transparent invoices for legal services, fostering trust and facilitating a seamless payment process.

The entire process, from the initial consultation to the finalized invoice for legal services, should be governed by a clear understanding of fees and associated costs.

Invoice for Legal Services: Detailed Breakdown of Costs

This section delves into the crucial components of an invoice for legal services, focusing on how costs are meticulously itemized and justified to ensure transparency and accountability.

A well-structured invoice for legal services is more than just a bill; it’s a detailed record of the work performed, outlining the specific legal services rendered, the time spent, and the associated expenses.

The careful breakdown of costs is essential for both the client and the legal professional. For the client, it provides a clear understanding of the value received for their investment.

For the legal professional, a precise invoice fosters confidence and facilitates accurate record-keeping, ensuring compliance with billing regulations and internal accounting practices. This detailed accounting process is crucial for managing finances and for creating a reliable history of completed work.

Within this breakdown of legal service costs, a detailed description of each service provided is paramount. The descriptions should be precise and clearly explain the tasks completed. For example, “drafting a contract” is more effective than simply “contract work.” Detailed descriptions provide substantial evidence for the invoice contents.

Time spent on specific tasks is another critical element. An itemized breakdown of the hours devoted to each activity is important. This precise tracking of time ensures accuracy, which is vital for avoiding misunderstandings and discrepancies.

Furthermore, the invoice should clearly delineate the specific legal services rendered. Examples of services include contract review, litigation support, or legal research. This detail allows the client to appreciate the scope of the work involved, enabling better budget allocation for future similar projects.

In addition to time and services, expenses associated with the legal work should be clearly listed and justified. These expenses can encompass court filing fees, expert witness costs, or travel expenses. This ensures a comprehensive presentation of costs, maintaining complete clarity about the financial implications of each case.

Accurate calculation of applicable rates and fees is imperative in an invoice for legal services. Understanding and adhering to professional standards regarding hourly rates, flat fees, or contingency fees is crucial for transparent and ethical billing practices. Accurate calculation of these charges directly impacts the client’s financial understanding and helps avoid disputes and ensure fairness in the exchange.

A well-structured invoice for legal services plays a pivotal role in maintaining client trust, facilitating clear communication about costs, and promoting transparency. This breakdown of charges, detailed above, demonstrates the importance of accurately itemizing costs, maintaining an audit trail, and upholding ethical billing practices—all essential elements of a professional legal service invoice.

Legal Service Invoice: Dispute Resolution and Collection Procedures

This section details the crucial procedures for resolving disputes and collecting outstanding amounts on legal service invoices. Effective dispute resolution is paramount to maintaining client relationships and ensuring timely payment.

A well-defined dispute resolution process within the invoice for legal services is vital. It should outline clear steps for addressing client concerns, from initial contact to formal mediation or arbitration, if necessary.

This section of the invoice for legal services should clearly detail the procedures for handling disputed invoices, outlining a specific timeframe for responding to client inquiries and resolving any discrepancies.

Implementing a comprehensive collection policy is essential for recovering outstanding balances. This section of the invoice for legal services should specify the steps to be taken when a payment is not received on time, including a graduated series of reminders and communications to the client.

Robust and timely communication is key throughout the collection process. This may include sending certified letters, making phone calls, or employing other legally permissible collection methods. Each step should be documented meticulously.

The dispute resolution and collection procedures outlined in the invoice for legal services should comply with all relevant state and federal laws. This ensures ethical and legal handling of any discrepancies or outstanding payments.

Clear and concise language within the invoice for legal services is crucial for preventing misunderstandings. Ambiguity can lead to disputes and complicate the collection process, potentially impacting client relationships.

A section within the invoice for legal services detailing payment terms and deadlines, with clear consequences for non-payment, further strengthens the collection process. This provides a framework for expectations and avoids potential conflicts.

Incorporating a readily accessible contact person or department for addressing client inquiries and resolving invoice-related issues enhances the client experience. This personal touch demonstrates professionalism and fosters trust in the legal service provider.

The success of the invoice for legal services hinges on a thorough understanding and execution of dispute resolution and collection procedures. This section should be meticulously crafted to navigate potential challenges and ensure the timely and efficient payment of fees.

In conclusion, a meticulously prepared invoice for legal services is crucial for both the legal practitioner and the client.

It serves as a legally sound record of the services rendered, clearly outlining the agreed-upon fees, expenses, and any applicable discounts or adjustments.

Properly formatted invoice for legal services documents the scope of work, ensuring transparency and accountability in the attorney-client relationship.

Without a clear and detailed invoice, disputes regarding payment and service delivery can easily arise, potentially hindering the smooth operation of a law firm and creating complications for clients seeking legal counsel.

Therefore, understanding the intricacies of creating and managing invoices for legal services is paramount for both professionals and their clients. Accurate and comprehensive invoices protect the interests of everyone involved, fostering trust and ensuring a professional, legally sound interaction.

Furthermore, this comprehensive documentation facilitates easier tracking of income and expenses, streamlining administrative processes within a law firm. The precise nature of legal work often involves substantial time commitments, intricate consultations, and numerous documents. A well-structured invoice for legal services acts as a vital tool for managing these complexities.

Ultimately, the professional and ethical handling of invoices for legal services demonstrates a commitment to transparency, accountability, and effective legal practice. It fosters a mutually beneficial and trustworthy relationship between attorney and client, setting a standard for the profession.

The importance of a correctly executed invoice for legal services cannot be overstated; it is a cornerstone of the legal process, impacting both financial and professional aspects.