Navigating the complexities of independent contracting often requires specialized legal counsel, particularly for those operating under a 1099 tax designation.

Understanding the intricacies of 1099 legal services is crucial for contractors to avoid costly errors and ensure compliance with tax regulations.

This article delves into the essential aspects of 1099 legal services, providing valuable insights into the critical role these services play in the modern freelance economy.

From contract negotiation to tax preparation, a robust 1099 legal service can empower independent professionals to maintain their financial security and navigate the often-challenging legal landscape.

The rise of the gig economy has created a demand for skilled professionals who can provide these services, offering expertise in various legal matters, from employment law to intellectual property.

These independent professionals frequently need to ensure contracts align with their tax obligations and the stipulations of 1099 classifications.

1099 legal services help to clarify the nuanced tax implications surrounding income earned as a contractor.

The importance of accurate tax filings and contract structuring is paramount for contractors who depend on consistent and reliable income, and choosing the right 1099 legal service can be the difference between financial stability and potential problems.

This guide unpacks the benefits of engaging a dedicated 1099 legal service, empowering contractors to make informed decisions about their legal and financial well-being.

Furthermore, this comprehensive exploration will cover specific scenarios where specialized expertise from a 1099 legal service provider is essential, emphasizing the crucial role legal services play in maintaining compliance.

Understanding the Scope of 1099 Legal Services

1099 legal services encompass a wide array of legal expertise tailored specifically for independent contractors operating under the 1099 tax designation.

These services are crucial for navigating the complexities of independent contracting, offering vital support for freelancers and consultants operating in the modern gig economy.

A key aspect of 1099 legal services is contract review and negotiation, ensuring that agreements protect the contractor’s interests and comply with relevant regulations.

These services address the potential pitfalls associated with independent contracting, including ensuring clear definitions of the working relationship, compensation structures, and responsibilities.

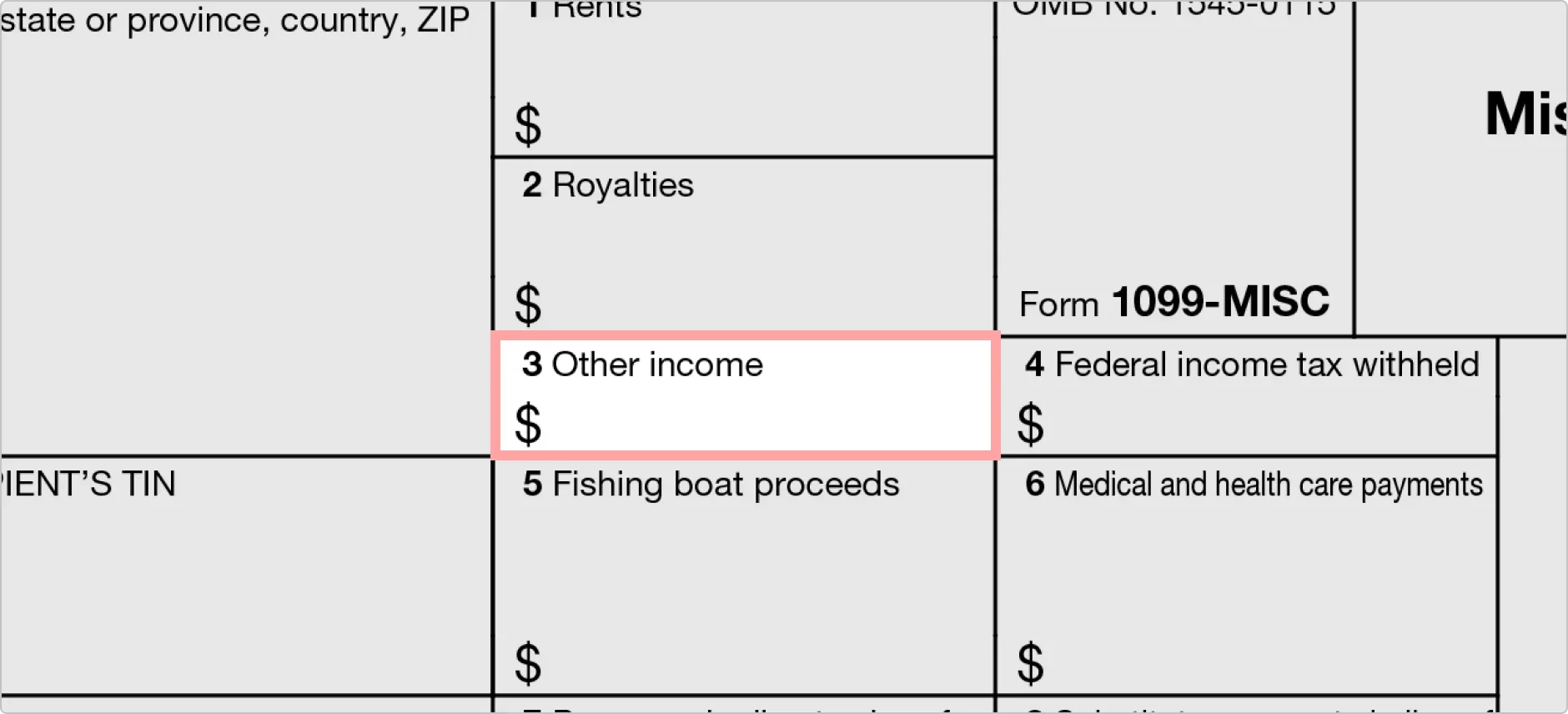

Furthermore, 1099 legal services frequently encompass assistance with tax preparation, ensuring compliance with IRS requirements and minimizing the risk of costly penalties.

This includes guidance on correctly reporting income and deductions, preparing accurate tax forms, and understanding the implications of specific contractual stipulations on tax liability.

Beyond contract negotiation and tax preparation, 1099 legal services can provide advice on a variety of legal matters, such as employment law, intellectual property rights, and data privacy.

Understanding the intricacies of employment law for 1099 contractors is vital for maintaining compliance and avoiding misclassifications.

This expertise helps independent professionals avoid potential misinterpretations or misrepresentations of their employment status, minimizing the risk of legal challenges or penalties.

A skilled 1099 legal professional can also guide contractors through licensing requirements, intellectual property issues, and data security concerns unique to their field.

The importance of 1099 legal services is compounded by the rise in freelance work, which has heightened the need for specialized support in navigating the legal landscape.

By providing expert guidance, 1099 legal services empower contractors to confidently manage their financial obligations and legal responsibilities, fostering a sustainable and compliant approach to independent work.

Ultimately, a robust 1099 legal service protects contractors from potential legal complications, allowing them to focus on their core business activities and grow their careers successfully within the 1099-classified sector.

Understanding the Scope of 1099 Legal Services

1099 legal services extend beyond simple contract review; they offer comprehensive support for independent contractors, addressing the nuances of their unique employment status.

A core component of these services is comprehensive contract review, crucial to protecting independent professionals from potential pitfalls within their agreements.

This includes meticulous analysis of contract clauses, ensuring clarity on the contractor’s responsibilities, compensation structure, and scope of work, maximizing the protection of the 1099 contractor’s rights.

Beyond contract negotiation, 1099 legal services address the complexities surrounding taxation for independent contractors.

This crucial aspect often includes guidance on proper tax form completion, ensuring accurate reporting to the IRS and averting potential tax liabilities.

Furthermore, these services address specific legal issues unique to the independent contractor realm, like intellectual property rights and dispute resolution procedures when working on a 1099 basis.

Expert legal counsel on 1099 legal services provides a significant advantage for freelancers, consultants, and other independent professionals operating in the gig economy, especially those involved in intricate or high-stakes projects. This support encompasses a detailed understanding of the specific employment regulations and laws relevant to 1099 contractors.

Professional 1099 legal services frequently include navigating the intricacies of independent contractor classifications, helping independent professionals avoid misclassification issues. Understanding and properly managing these classifications is key to ensuring compliance and preventing potential legal challenges.

This support goes beyond mere contract review and encompasses a deeper understanding of the tax implications of the 1099 contractor’s specific industry or profession.

1099 legal services also address the evolving legal landscape, ensuring clients are well-versed in any recent changes to relevant regulations.

This proactive approach is crucial to maintaining compliance and preventing potential legal issues in the constantly changing world of independent contracting. By remaining aware of and anticipating future legislation affecting 1099 contractors, these services help maintain their financial and professional security.

The increasing prevalence of the freelance economy necessitates specialized legal support. These services become even more crucial for ensuring that 1099 contractors are not only compliant but also positioned for success in their work.

Independent Contractor Status and 1099 Legal Services

This section delves into the crucial aspect of independent contractor status, specifically as it relates to 1099 legal services.

Accurate classification of a legal professional as an independent contractor, rather than an employee, is paramount for compliance with IRS regulations concerning 1099 reporting.

Properly classifying 1099 legal service providers is vital to avoid significant tax implications and potential legal issues for both the provider and the client.

Misclassifying a 1099 legal services provider as an employee can result in substantial penalties for the hiring entity, including back taxes, interest, and potentially fines.

Understanding the nuances of independent contractor status under the IRS’s guidelines is critical for ensuring legal compliance and avoiding costly mistakes related to 1099 legal services.

The IRS examines factors such as the degree of control exercised by the hiring entity, the worker’s opportunity for profit or loss, and the nature of the services provided to determine independent contractor status, which is critical for all 1099 legal services.

Many factors differentiate an independent contractor from an employee, particularly in the context of legal services provided on a 1099 basis. These factors include the extent of control the client possesses over the legal service provider’s work, the nature of the relationship between the legal service provider and the client, and the provider’s opportunity for profit or loss from the service engagement.

For 1099 legal services, the independent contractor retains significant autonomy in their work processes, determining their own hours, working environment, and potentially working with multiple clients simultaneously.

The legal service provider’s ability to hire their own support staff and utilize their own tools further strengthens their independent contractor status.

Conversely, a stronger indication of an employee relationship is established when the client controls substantial aspects of the service provider’s work, dictating deadlines, providing detailed instructions, and providing significant oversight beyond simple project goals.

These distinctions are crucial for avoiding misclassification issues, which can lead to significant penalties under tax laws, particularly for 1099 legal services.

Accurate classification not only satisfies legal obligations but also fosters transparency and trust between the legal service provider and the client, a crucial consideration for the 1099 legal services industry.

Therefore, understanding and correctly applying the criteria for independent contractor status is fundamental for the smooth operation and long-term success of any business offering 1099 legal services.

Professional legal advice should always be sought when clarifying the classification of independent contractors, particularly concerning the provision of 1099 legal services, ensuring full compliance with all relevant regulations.

1099 Legal Services: Independent Contractor Status and Tax Implications

This section delves into the crucial aspect of independent contractor status for legal professionals operating under 1099 arrangements, emphasizing the nuances surrounding tax obligations.

Properly classifying a legal professional as an independent contractor rather than an employee under a 1099 legal services agreement is critical for both the practitioner and the client.

Distinguishing between these two classifications is often the pivotal point in determining tax responsibility, and the implications for 1099 legal services are substantial.

Failure to accurately classify a 1099 legal services provider can lead to significant penalties and legal challenges for both the service provider and the client.

A 1099 legal service provider, operating as an independent contractor, is responsible for their own taxes, including Social Security and Medicare, which are often overlooked when someone operates as an employee.

The Internal Revenue Service (IRS) scrutinizes these classifications meticulously, as misclassification can have severe repercussions. This underscores the importance of meticulous record-keeping for 1099 legal services, including detailed contracts outlining the scope of work and the independent contractor relationship.

Understanding the difference between employee and independent contractor classifications within the context of 1099 legal services is paramount for compliance and avoiding legal issues.

The provider of 1099 legal services is responsible for remitting their own self-employment taxes, including estimated quarterly payments. This is distinct from the employer withholding taxes from an employee’s paycheck.

Furthermore, independent contractors using 1099 legal services arrangements typically don’t receive employer-sponsored benefits, like health insurance or retirement plans, which is a key consideration for 1099 legal service providers.

Consequently, a thorough understanding of these specific tax and employment classifications is essential for both parties involved in 1099 legal services contracts, to ensure compliance with the law and avoid potential liabilities.

In conclusion, the rise of 1099 legal services reflects a significant shift in the legal landscape, driven by the increasing demand for flexible and cost-effective legal solutions.

This article has explored the multifaceted nature of 1099 legal services, highlighting their benefits for both clients and independent legal professionals.

From specialized legal expertise to tailored hourly rates, these services address the needs of businesses and individuals across a spectrum of legal matters, from contract review to litigation support.

The key takeaway is that 1099 legal services offer a viable alternative to traditional, full-time employment models, offering greater flexibility, control, and potential cost savings for all involved.

As the gig economy continues to evolve, the demand for 1099 legal services is poised to increase, underscoring their crucial role in the modern legal industry. This approach allows for specialized expertise to be accessed on an as-needed basis, whether for quick consultations, drafting contracts, or ongoing litigation support, addressing the particular needs of modern businesses and individuals without the complexities of traditional employment structures.

Ultimately, the flexibility and cost-effectiveness inherent in 1099 legal services make them a powerful tool in the legal arsenal of both clients and independent legal professionals, solidifying their importance in the current market.

Businesses seeking to streamline their legal operations or individuals requiring expert legal guidance on a project basis can significantly benefit from leveraging these 1099 legal services, ensuring that legal expertise is available precisely when needed.